Building the Future of Camino Science, Together

Your foundational AI platform has the potential to redefine biotech. This interactive proposal outlines a collaborative, data-driven partnership to transform Camino Science from a brilliant technology into a venture-backed, market-defining enterprise.

The Strategic Imperative

Camino Science is at a critical inflection point. To attract premier investors in today's "flight to quality" market, we must address key milestones together.

Focus the Platform

Identify and validate the single most compelling market application to demonstrate clear product-market fit, a prerequisite for funding in a cautious market.

Complete the Team

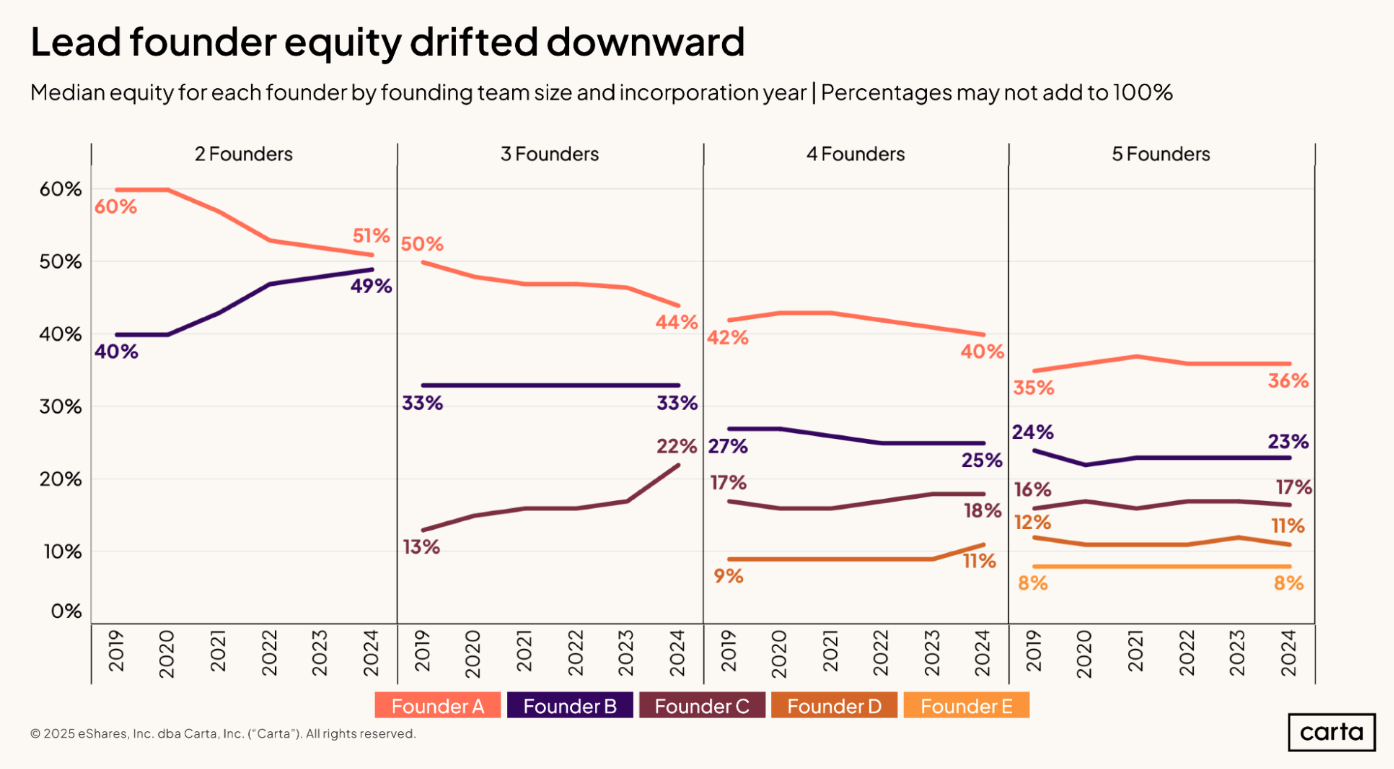

Overcome the solo-founder hurdle. Data shows teams secure 83% of VC funding versus only 17% for individuals. This partnership immediately creates the balanced team investors want.

Prepare for Investment

Navigate the financial cleanup, address existing debt, and optimize the cap table to present a clean, professional, and de-risked opportunity to sophisticated institutional investors.

Our Joint Blueprint for Value Creation

A three-pillar action plan to systematically de-risk the company and unlock its full potential.

Pillar 1: Fundable Business Model

Lead a rigorous discovery process to identify the highest-value application for the AI model, creating a data-driven business plan that transforms the technology into an investable company.

Pillar 2: Secure Seed Funding

Spearhead a professional fundraising effort to secure a €5M-€10M seed round at a premium valuation from top-tier VCs, creating a competitive process to ensure the best terms.

Pillar 3: Build Leadership Team

Once funded, lead the executive search to recruit a permanent, world-class biotech CEO to ensure long-term success and allow the founder to focus on technical innovation.

Interactive Value Creation Model

The goal is not to divide the current pie, but to grow a much larger one. This model demonstrates how strategic partnership creates exponential value for all stakeholders.

Expected Value Analysis: Solo vs. Partnership

This partnership is projected to generate over **21 times more expected value** for your personal stake.

Long-Term Value Projections

Select a scenario to see how the value of each stake grows through successive funding rounds.

(Note: Projections assume the Employee Stock Option Pool is topped up to 8% at each funding round.)

| Stage | Investment | Valuation | Founder Ownership Value | Angel Ownership Value | MBA 1 Ownership Value | MBA 2 Ownership Value | Employee Stock Option Pool | Investors Ownership Value |

|---|

Stakeholder Value Growth Over Time

A Fair and Aligned Partnership Structure

The proposed terms are designed to be transparent, founder-friendly, and grounded in market data to ensure a win-win structure.

We propose an equity stake of

12.5% each

(25% combined), earned as a success fee for creating over €17M in new enterprise value.

Market-Calibrated Justification

The Pre-Seed Biotech Standard

25%

Mean equity for an active, part-time founding scientist in a life science company, per Cornell University analysis.

The Venture Builder Model

34%

Average stake taken by venture builder firms for executing the 0-to-1 business creation process.

Summary of Proposed Terms

Equity Stake

12.5% common shares each, dilutable.

Vesting

100% milestone-based, ensuring equity is earned only on delivery of tangible results.

Founder Control

Key decisions require 75% shareholder consent, protecting your strategic influence.

Roles

Co-CEO and Chief Business Officer (CBO).

Board Role

One combined, non-voting Observer seat to provide support without diluting control.

No-Risk Trial

A 30-day 'out clause' with no obligations to validate our partnership dynamic.